Is It Better to Inherit a Roth or Traditional Ira

RMDs are determined by your age and life. This is because contributions.

When It S A Bad Deal To Inherit A Roth Ira

Returns from cash investment will be taxed at regular or capital gain.

. In the case of the former the distributions are tax-free and in the. If it was your spouse you can transfer the IRA into your own account or retitle the account in. Ad Discover The Benefits Of A Roth IRA.

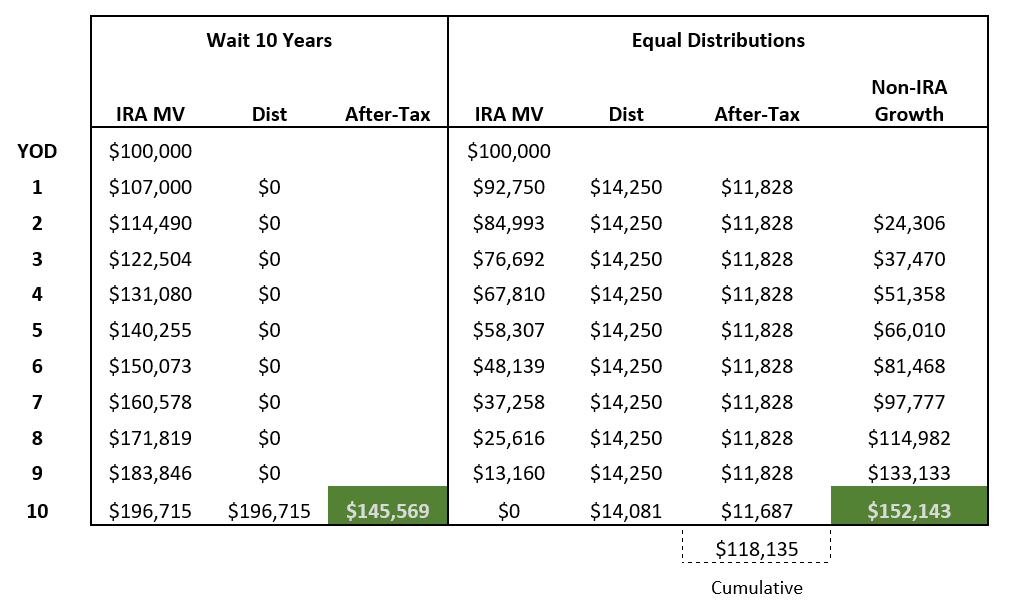

But with the SECURE Act taxes are bunched into a 10-year period and can substantially erode the value of an inherited traditional IRA. Ad Read Tip 91 to learn more about Fisher Investments advice regarding IRA accounts. Earlier we discussed the difference between a Traditional IRA vs Roth and how you might want to choose one over the other in the context of estate planning.

Take Advantage of Potential Tax Benefits When You Open a TD Ameritrade IRA Today. A Roth IRA that is opened the same day and has an identical contribution history and interest rate as a traditional IRA has the potential to net more to the heir. Learn About 2021 Contribution Limits Today.

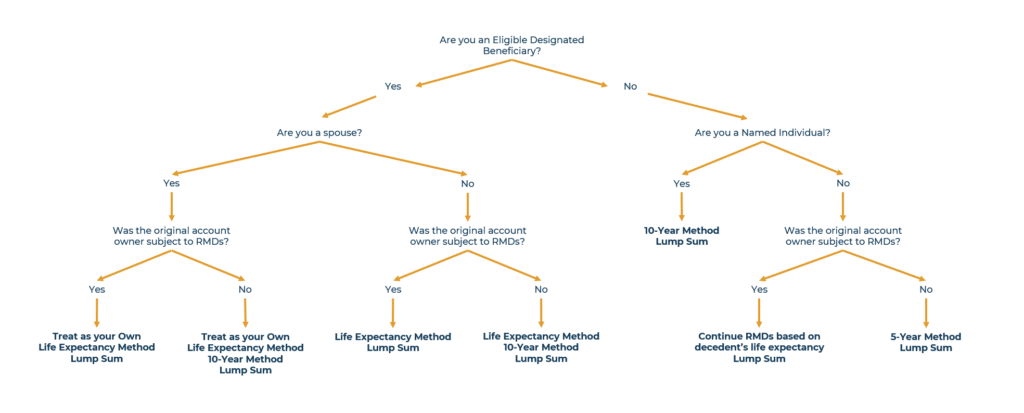

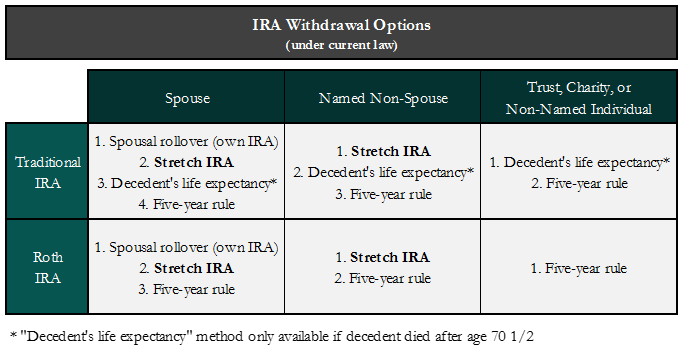

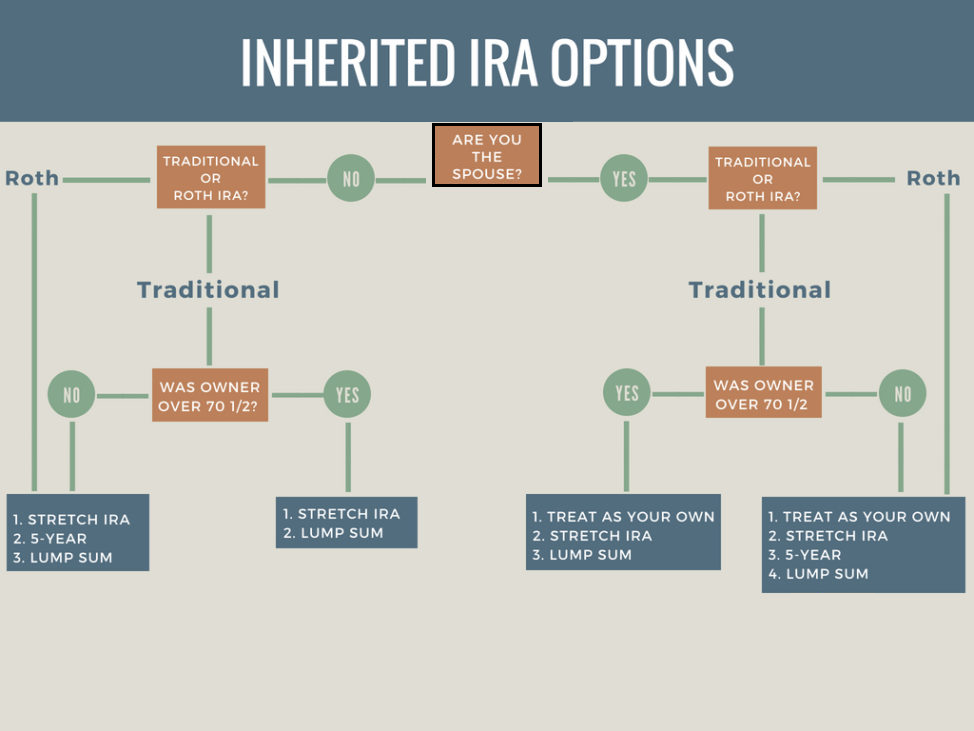

Roll Over Into A TIAA IRA Get A Clearer View of Your Financial Picture. A Roth IRA and a traditional IRA individual retirement account offer valuable retirement-planning benefits but with different structures income limits and pros and cons. If youve inherited a traditional IRA your options depend on who died and left you as a beneficiary.

The rules for an inherited IRA depend on the specifics of your situation as well. In this case the traditional IRA is a better bet than the ROTH. Inherited Roth IRA Life Expectancy Method You can set up an inherited Roth IRA and take distributions through your lifetime.

Conventional wisdom suggests that inheriting a Roth IRA is always better than inheriting a traditional IRA. Inheriting an IRA whether a traditional or Roth account comes with certain responsibilities. Find Out with Help from Fidelity.

Ad Which IRA Is Right for You. How does the tax liability work. Explore Your Choices For Your IRA.

Discover if a Roth IRA will work for your portfolio in 99 Retirement Tips. You can inherit a Roth individual retirement account IRA and avoid a lengthy court process known as probate as long as the person who passed away listed you as a. Ad Get Up To 600 When Funding A New IRA.

Find Out with Help from Fidelity. Are there required - Answered by a verified Tax Professional. Schwab Has 247 Professional Guidance.

Get Up To 600 When Funding A New IRA. Ad It Is Easy To Get Started. Explore Choices For Your IRA Now.

Roth IRA is better than cash. We use cookies to give you the. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Schwabs Rollover Consultants Can Assist You From Start To Finish. Ad TIAA IRAs Can Give You The Flexibility And Convenience You May Need. That being said people love ROTH IRAs.

The decision tends to come. If you inherit a Roth IRA from someone other than your spouse you are not permitted to make contributions to the inherited Roth IRA or combine it with any Roth IRA you established for. Ad Refine Your Retirement Strategy with Innovative Tools and Calculators.

Ad Which IRA Is Right for You. You can keep in Roth invested for 10 years after inheritance and your returns are tax free. Is it better to inherit a traditional ira or a roth ira.

Roth IRAs For those who already. We Go Further Today To Help You Retire Tomorrow. They love the idea of tax-free growth forever and leaving a tax-free inheritance to their.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

I Inherited An Ira What Should I Do Now Cutter Financial Group

When It S A Bad Deal To Inherit A Roth Ira

Understanding The Secure Act Managing The 10 Year Rule Financial Planning Insights Manning Napier

What Can I Do With An Inherited Roth Ira Youtube

What To Do If You Inherit An Ira Post Secure Act Wealthspire

Inherited An Ira In 2020 Or Later Make Sure You Know The New Rule Financial Symmetry Inc

How The Death Of The Stretch Ira Could Give New Life To Roth Iras Seeking Alpha

Secure Act Overview And Personal Financial Planning Items

You Ve Inherited An Ira What Happens Next Cd Wealth Management

Inherited Iras Rmd Planning And 7 Things To Know Boeckermann Grafstrom Mayer

Inherited Ira Rules Before And After The Secure Act Aaii

Wealth Planning Insights The Secure Act S Impact On Beneficiary Distribution Requirements Fi3 Advisors

Inheriting An Ira What Taxes Do I Need To Pay Smartasset

Inheriting An Ira Virginia Beach Tax Preparation

The Beauty Of The Inherited Ira Resilient Asset Management

Inherited Ira Rules Before And After The Secure Act Aaii

Inheriting An Ira From Your Spouse Know Your Options New Century Investments